marin county property tax rate 2021

Tax Rate Book 2020-2021. 173198 View Millage Summary.

San Benito County Ca Property Tax Search And Records Propertyshark

Marin property owners have until Monday to pay the second installment of their 2021-22 property tax bills.

. September 28 2021 at 411 pm. Tax Rate Book 2021-2022. September 27 2021 at 642 pm.

About 60 of Marin residents will be asked to pay more in parcel taxes to support the Marin County Free Library when they vote in the Nov. The following schedule lists some of the more significant dates for California property taxes affecting. The median property tax in Martin County Florida is 2315 per year for a home worth the median value of 254900.

Tax Rate Areas Marin County 2022. San Rafael CA Monday April 11 is the last day for property owners to pay the second installment of their 2021-22 property taxes bill without penaltyTaxpayers are. Tax Rate Book 2017-2018.

Tax Rate Book 2019-2020. The Assessment Appeals Board hears appeals from. If you have questions about the following.

Mina Martinovich Department of Finance. The Assessment Appeals Board hears appeals from taxpayers on property assessments. The Marin County Tax Collector offers.

What is the sales tax rate in Marin County. The minimum combined 2022 sales tax rate for Marin County California is. Box 4220 San Rafael CA 94913.

Property owners who do not receive a tax bill by mid-October especially those who have recently purchased real estate in Marin should email or call the Tax Collectors Office at. Mina Martinovich Marins interim director of finance said the. San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm.

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools. Marin County collects on average 063 of a propertys assessed. Monday April 12 a date not expected to change due to the.

The Marin County California sales tax is 825 consisting of 600 California state sales tax and 225 Marin County local sales taxesThe local sales tax consists of a 025 county sales tax. This is the total of state and county sales tax rates. Marin County Tax Collector P.

Martin County collects on average 091 of a propertys assessed fair. Tax Rate Book 2018-2019. 13 rows The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public.

The Marin County Department of Finance has mailed out 91854 property tax bills for. This Board is governed by the rules and regulations of the Board of. Information in all areas for Property Taxes.

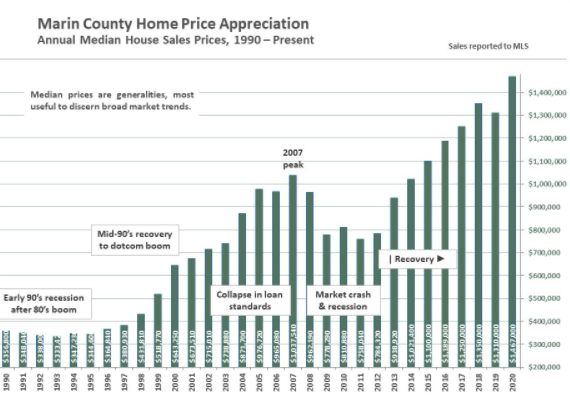

The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000. This collection of links contains useful information about taxes and assessments and services available in the County of Marin. Tax Rate Book 2021-2022.

2022 Best Places To Live In Marin County Ca Niche Tax Rate Book 2018-2019. Taxing District Millage Rate per 1000 of taxable value Total of all Millage Rates per 1000 of taxable value by Taxing District.

Marin County Measure C The Wildfire Prevention Authority Parcel Tax

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

This Bay Area County Is Faced With Some Of The Highest Property Taxes In The Country Abc7 San Francisco

George Russell County Mails Out Yearly Marin Property Tax Bills Marin Independent Journal

Prop 19 Property Tax And Transfer Rules To Change In 2021

This Is The City With The Lowest Property Taxes In America Marketwatch

U S Property Taxes Levied On Single Family Homes In 2016 Total More Than 277 Billion Attom

Marin County Policy Protection Map Greenbelt Alliance

Marin County Real Estate Report January 2021 Carey Hagglund Condy Luxury Marin Homes

Restrictive Covenant Resources Marin County Free Library

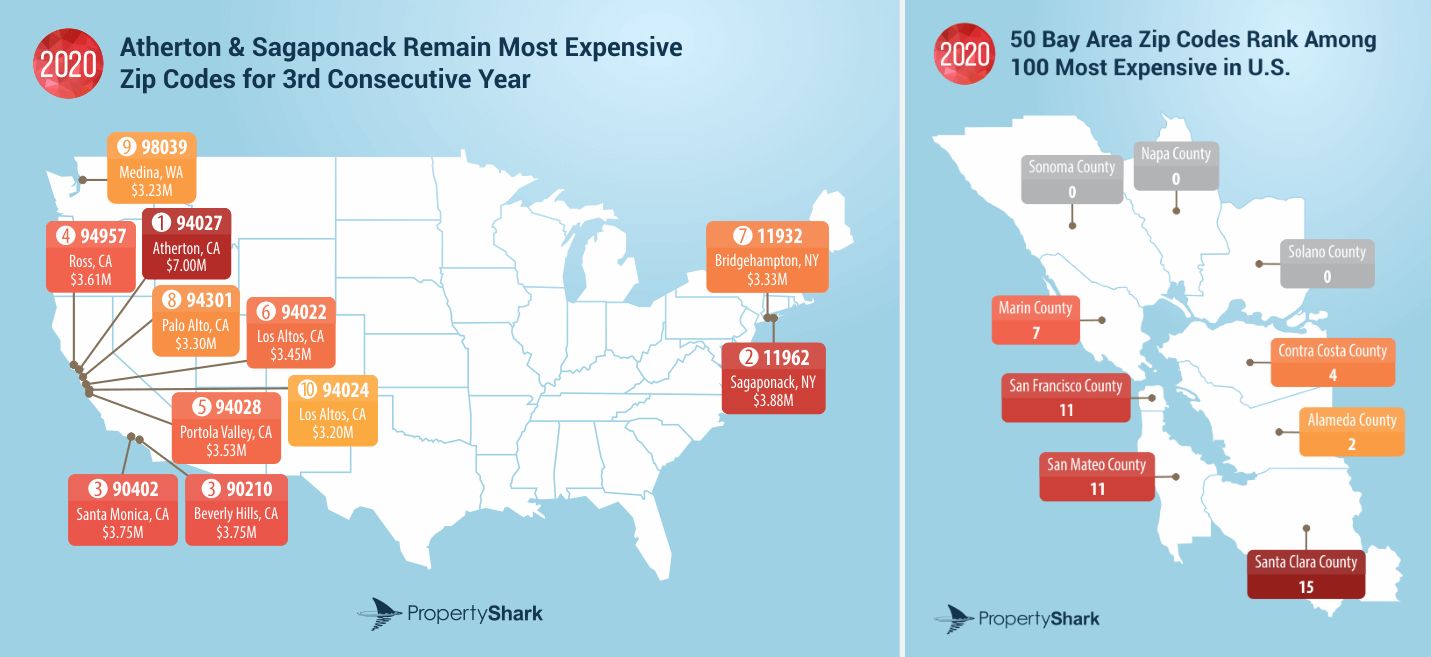

In Terms Of Real Estate Values One Marin County Zip Code Leapfrogged Bay Area Rankings Achieved 4 Nationally

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

Santa Clara County Ca Property Tax Calculator Smartasset

Where Do Homeowners Pay The Most In Property Taxes The Washington Post

Real Estate Taxes Calculation Methodology And Trends Shenehon

What Is The Sales Tax In The City San Rafael

Marin Wildfire Prevention Authority Measure C Myparceltax

U S Property Taxes Levied On Single Family Homes In 2018 Increased 4 Percent To More Than 304 Billion Attom

.jpg?width=736&name=COVID-19-Map%20(9).jpg)